The following is an excerpt from the Hawaii Business Magazine article “It’s Gotten Both Worse and Better for Struggling Working Families“ written by Noelle Fujii-Oride.

The nonprofit INPEACE’s financial education program started with a workshop at Wai‘anae District Park about 10 years ago. Saydee Pojas was working in INPEACE’s early childhood program; she says she wanted to help people avoid the financial struggles she encountered as a young adult. About 30 people showed up eager to learn.

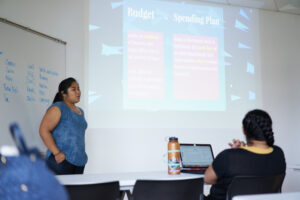

INPEACE’s Ho‘oulu Waiwai (“to build wealth”) program has been running for eight years now and has provided financial workshops and counseling for over 1,600 people, most of them Native Hawaiian. The program uses mo‘olelo (Hawaiian stories) and ‘ōlelo no‘eau (Hawaiian proverbs) to help participants better understand financial concepts.

If you’re talking about how people would fish and only take enough for their family but then make sure there’s still some in the water to fish later, it’s the same concept with your money

-Saydee Pojas

“How do you make sure you have enough for now but how do you save some for later and let it grow a little bit longer? It’s in that teaching that we’ve been able to help people grasp that knowledge a little bit easier.”

Topics include estate planning, budgeting, paying for college or child care, borrowing money and maximizing one’s income. Participants can drop into whichever workshops meet their needs.

Pojas says the program has served ALICE families that over time have been able to reduce debt, move out from their relatives’ homes and purchase their own places. Participants have been able to decrease their debt by an average $3,302 per year. The average credit score increase is 52 points. What’s been key, she says, is letting participants take the lead on how they want to grow. INPEACE’s staff provides the guidance and motivation.

Read the full article at It’s Gotten Both Worse and Better for Struggling Working Families – Hawaii Business Magazine